If you are a frequent user of online banking, you may take a few necessary steps to protect against online banking fraud. Online banking fraud is all about gaining access to your online bank account by stealing sensitive information. The most important element to protect your online account is to become aware of the ways your account information may fall into the hand of the fraudsters.

What can I do to protect my online bank account?

You need to make sure you have taken the following steps to secure your computing devices and email accounts so that a fraudster cannot trick you gain your bank details.

1. Protect the device that you are using for online banking

As a first step to secure your online bank account, you need to secure the entry points that your use to login to your account. The entry point can be mobile a device, a laptop or even a public computer. It is better not to use a public computer and public Wi-Fi service to access online bank account. If you are using computer to access your account, make sure you have a reputed antivirus and antimalware solution installed. Also, make sure your browser is updated and get rid of unnecessary browser plugins. Try to learn about the security features of the operating system you use in your devices including the mobile operation systems. Apply the OS security patches regularly.

Apart from you who else is accessing your computer. Even if you apply the best security settings of the world and run a security audit on your computer every day, you will not be able to protect your online bank account information if someone can access your computing device on your absence. Therefore, you must apply a strong password to your computer and mobile phone, and do not write down the password on paper. Try to memorize your password.

2. Online bank account password and email address

Always set up a strong password for your online bank account and make sure the email address associated with the bank account has a strong password. Ask your bank about the password reset process and test yourself the process to see how difficult it is to reset your online banking password. Never use the same password for your bank and for the email address.

3. Memorable information associated with the online account

Most online bank account allows setting memorable information. This memorable information you need to type in before entering password, adding an extra layer of security to the account. Do not use easily guessable numbers such as your date of birth as memorable information. Make sure the information you are using only known to you. You may also have setup a security questions for your email address. This security question is used to get back hacked email address. Never use the same security question twice and always avoid using easily guessable information such as your pet name.

4. Two factor authentication

You can contact your bank to learn how to enable two-factor authentication for your account. Two-factor authentication will make sure that the fraudster will not be able to access your account even if your password is compromised. Apply two-factor authentication for your email address as well. If you are using Gmail account, read this post about how to setup two-factor authentication on Gmail account.

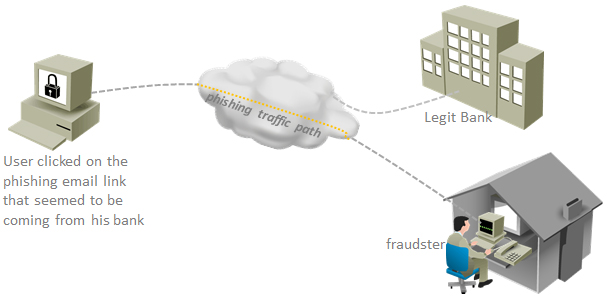

5. Avoid opening email sent from your bank/phishing email

Emails are still used as a primary mechanism to deliver malicious code to computers or to bait to click on a link that appears to be from a legit website such as from your bank. The attacker may use a spoof email address, and use the exact same format that the bank use to send emails to its customers. The phishing email can also contain a phone number to request you to dial a number. Once you dial that number, you may hear that the automatic voice is telling you to enter your bank account details and PIN to confirm your identity.

The reality is that a bank or a legit entity will never send you an email to change your personal information. If you receive such emails then you can contact with your local branch to confirm. In addition, you should avoid downloading any attachment sent to your email -even if it comes from a known email address- unless you are expecting a document in attachment from someone.

Finally, the above-mentioned approaches might significantly reduce the probability of exposing your sensitive information, but be wary about social engineering as well such as phone calls or SMS phishing where you may be prompted to reveal your account details.